illinois employer payroll tax calculator

Discover ADP Payroll Benefits Insurance Time Talent HR More. Discover ADP Payroll Benefits Insurance Time Talent HR More.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Illinois tax year starts from July 01 the year before to June 30 the current year.

. Get Started With ADP Payroll. Illinois State Disbursement Unit. Social Security 62 of an employees annual salary1.

This applies to workers over the age of 18. Ad Process Payroll Faster Easier With ADP Payroll. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

The maximum an employee will pay in 2022 is 911400. The standard FUTA tax rate is 6 so your max. Get Started With ADP Payroll.

Just enter the wages tax withholdings and other information required. Ad Process Payroll Faster Easier With ADP Payroll. Heres a step-by-step guide to walk you through.

Employees cost a lot more than their salary. This years guidelines saw a modest increase. So the tax year 2021 will start from July 01 2020 to June 30 2021.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Carol Stream IL 60197-5400. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Mail completed forms and payments to. The following points apply to Illinois payroll taxes.

That makes it relatively easy to predict the income tax you will have to. Illinois payroll taxes are exempted for the employees who are non-residents in. Newly-created businesses employing units must register with IDES within 30 days of start-up.

Your employer will withhold money from each of. What are some of the payroll taxes that employers pay. For more IDES employer contact information or call.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Medicare 145 of an employees annual salary1. You may pay up to 050 less an hour for your new hires in their first 90 days of employment.

In 2022 the Illinois state unemployment insurance SUI tax rate will range from 0725 to 71 with a maximum taxable wage base of 12960. Online - Employers can register through the. There is a flat rate of taxation on net income which is 495.

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Calculating your Illinois state income tax is.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. The Employer Services Hotline at 800. Illinois child support payment information.

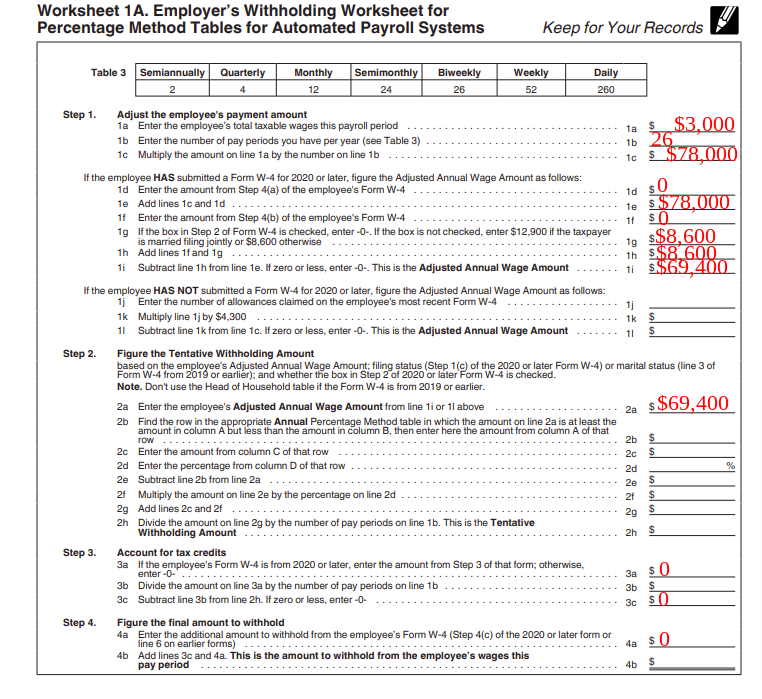

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. Remit Withholding for Child Support to. Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

Pre Tax Vs After Tax Medical Premiums

![]()

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Illinois Paycheck Calculator Smartasset

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Payroll Taxes Taxes And Percentages

Aflac Supplemental Insurance Information Aflac Insurance Life

Illinois Paycheck Calculator Adp

2022 Federal Payroll Tax Rates Abacus Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

2021 Federal Payroll Tax Rates Abacus Payroll

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

What Is Fica Tax Contribution Rates Examples

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate